axis bank video kyc :

axis bank video kyc: You and I have heard the name of Axis Bank KYC many times, but why is it necessary to do KYC in the bank? KYC is a process in which you have to prove your identity before opening an account. In today’s time, the process of KYC is also being done in two ways.

1. offline; 2. online

1. Offline: This is the process which you can easily complete at home. To complete online KYC, you need a PAN card an Aadhaar card, certificate, driving license and a signature.

2. online

You can go to your nearest branch and get your PAN card, Voter card, Aadhar card or certificate verified and complete your KYC.

Benefits of video KYC for Axis Bank !

The link for video KYC is valid for only 24 hours.

Video KYC takes only 2–4 minutes.

Fill the KYC process correctly.

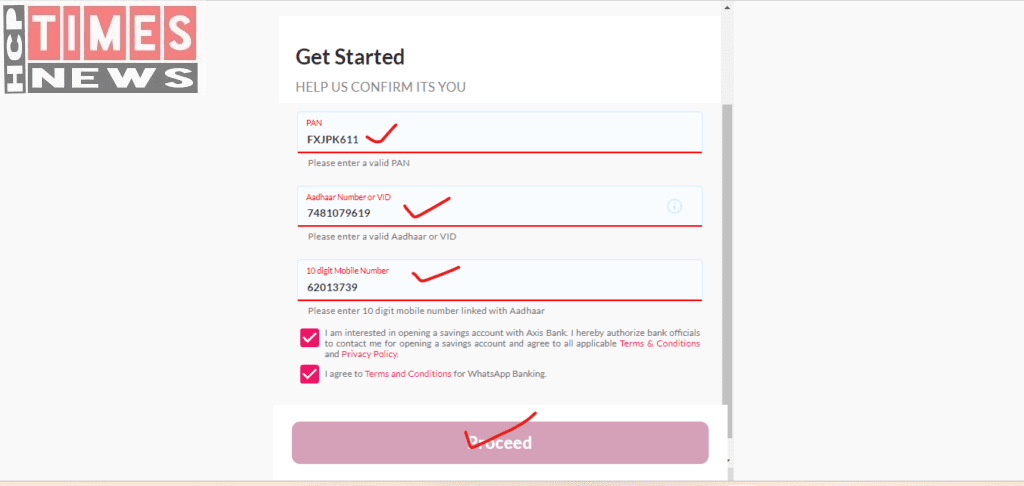

How to do video KYC for credit card in Axis Bank

The process of Video KYC is simple.

Visit Axis Bank credit card page.

Enter your XDigit Application ID number and fill out the OTP.

For verification, bank officer will talk to you face-to-face.

For video KYC, you must have your PAN card and hard copy with you.

When your video KYC is done, bank officer will do face-check of both your Aadhaar card and PAN card.

ALSO READ: Postcard Travel Club Introduces an Interests-Based Search Engine for Conscious Travelers

What are the important things for Video KYC?

While doing video KYC, you should get it done from your home location only.

Keep a hard copy of PAN card and Aadhar card ready.

When you are doing video KYC, you must have a good internet connection.

Answer the questions asked by the bank officer correctly.

Axis Bank Credit card का benefits !

You can get a lot of benefits from the payments you make through a credit card. It helps you pay for your purchases with interest later. If you use a credit card, then know about some of its benefits.

You can make secure transactions with a credit card.

Whether you do household work or work abroad, a credit card works for both. A

credit card provides interest-free payment for a few days.

How to use Axis Bank credit card smartly?

Axis Bank credit card video KYC Not Eligibility !

When you apply for a credit card, should we do video KYC of the customer or should we do online KYC of the customer? It depends on the bank.

When your application goes to the bank, you feel that I have not submitted any document yet, how will the bank know that the card we have applied for will be a video KYC, it will be an offline KYC.

Why does KYC option not come quickly in Axis Bank?

When you fill the form, make sure that you fill in the proper name and address as per your Aadhaar card. When you fill the form, make sure that you fill in the details mentioned in the Aadhaar card correctly. If you have filled the details correctly, you will get the KYC option immediately.

ALSO READ :- online account opening for axis bank step by step process !